从2018年6月4日起,公众号每发布一篇文章,就为大家分享一张Octodex的创意图。

# 003

今天分享一篇基于PPT的高频交易研究。解读了部分内容,其余部分大家可以在【阅读原文】下载代码自行研究。

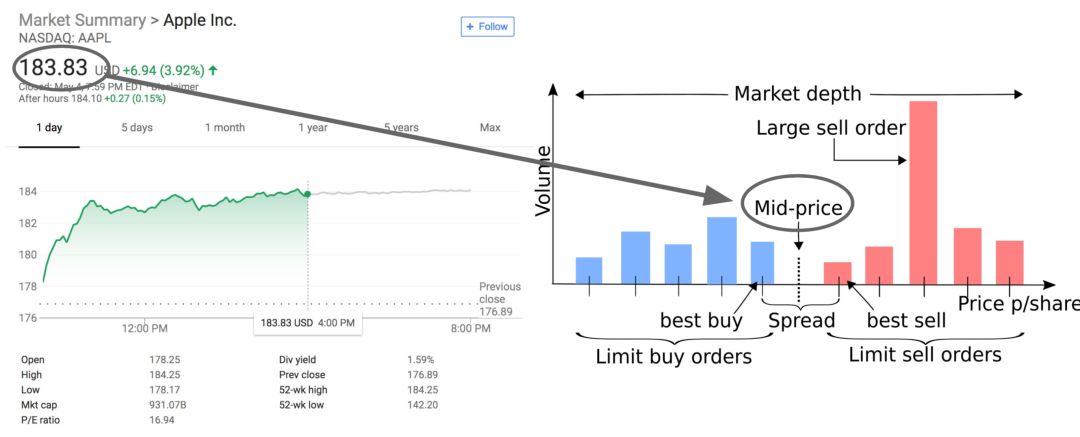

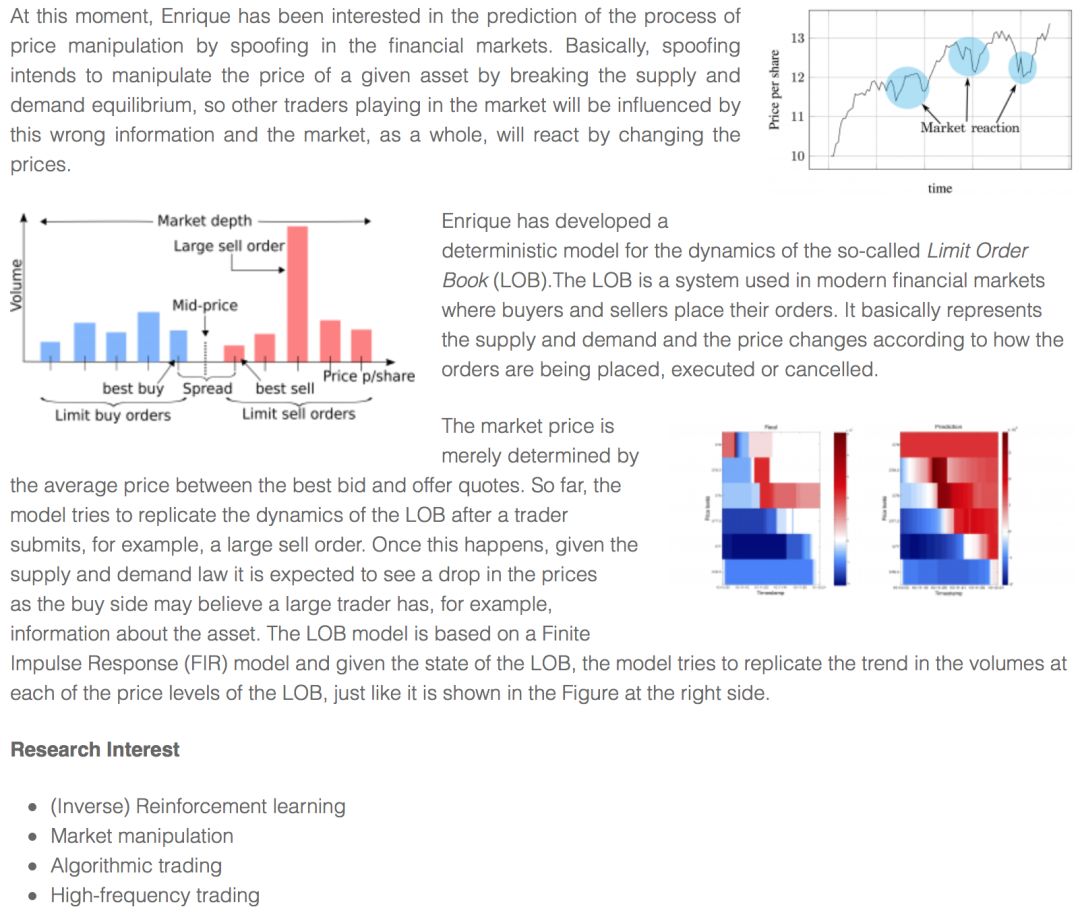

限价订单薄(LOB)

- Top of the Book - highest bid and the lowest ask orders

- Price levels - several orders at the same price

- Book depth - number of price levels available at a particular time in the book

- The LOB data gives traders insight into supply and demand of market microstructure, and short-term price movements

解释LOB

来源:https://nms.kcl.ac.uk/rll/enrique-miranda/index.html

推荐这个网站哈!

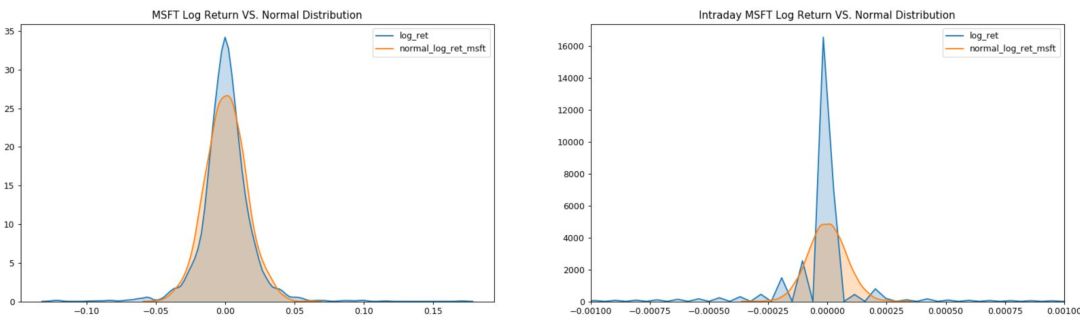

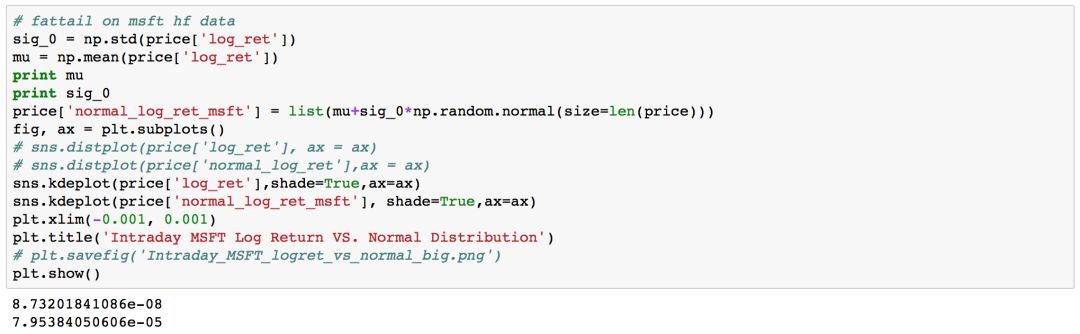

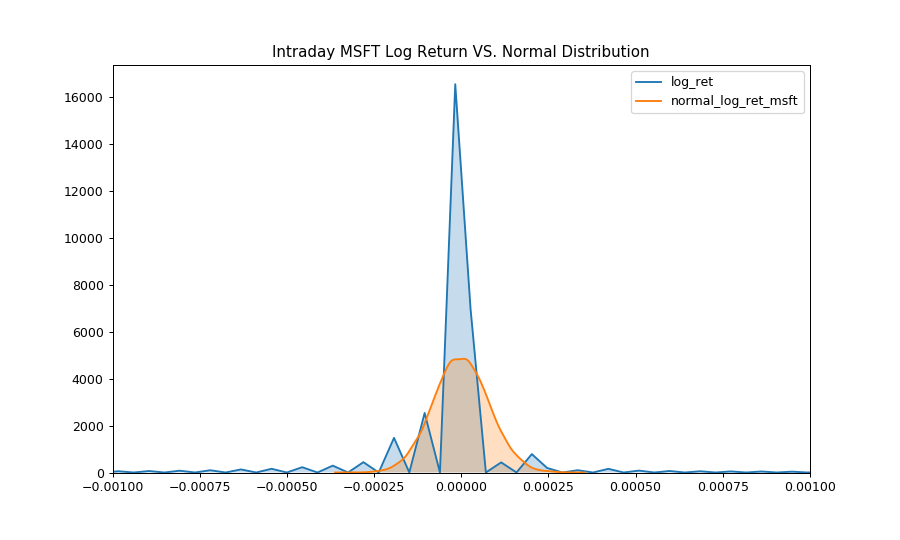

- 高频价格与每日价格

HF return - significantly smaller mean and variance, but sharper peak and fatter tail(肥尾)

代码展示

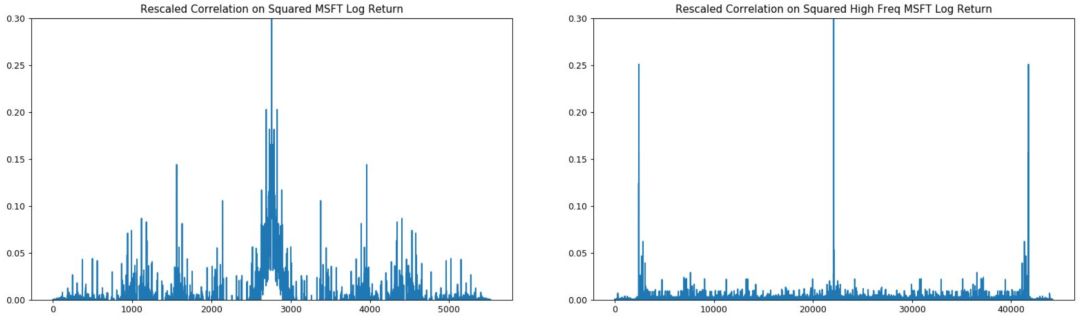

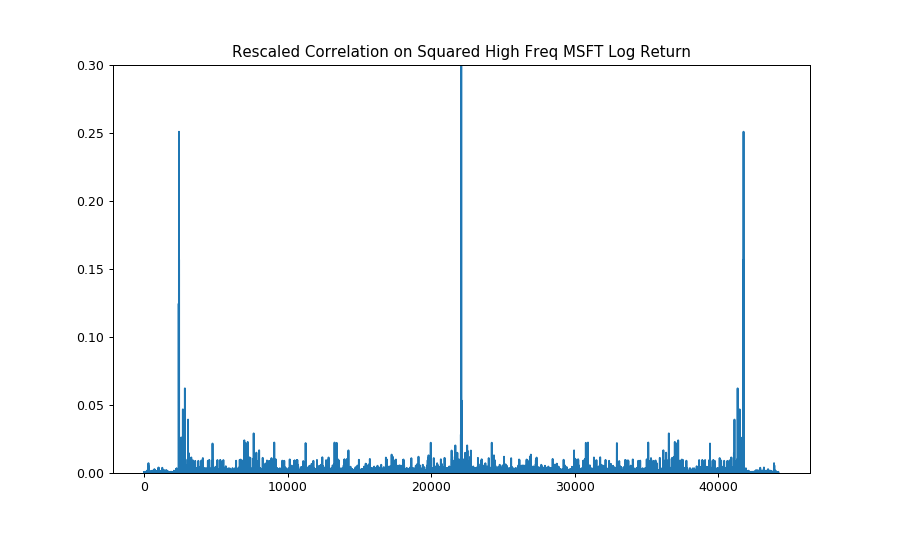

自相关性

High frequency log return - significantly less autocorrelation - fails to meet strong autocorrelation assumption of time series models.

代码展示

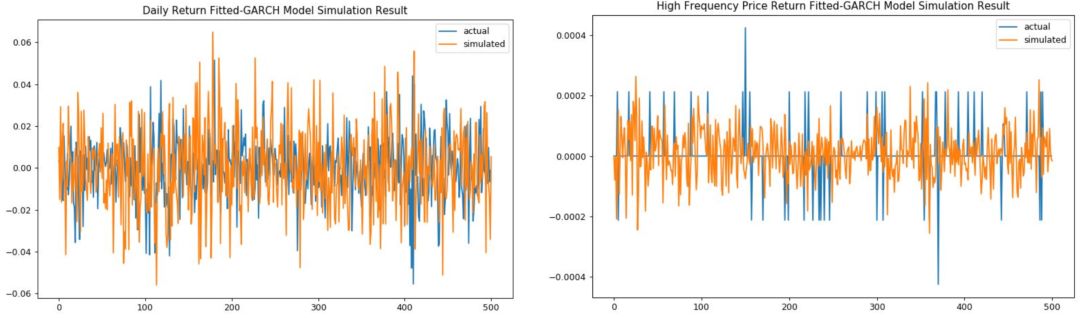

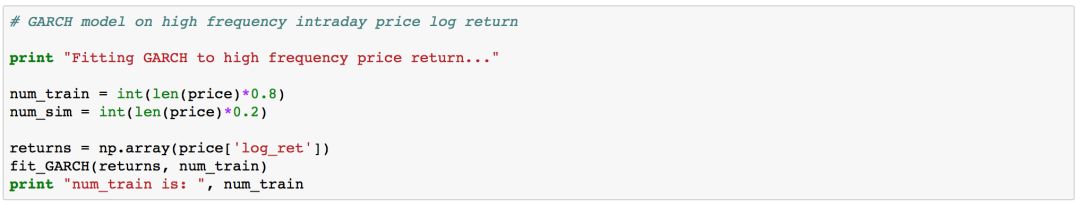

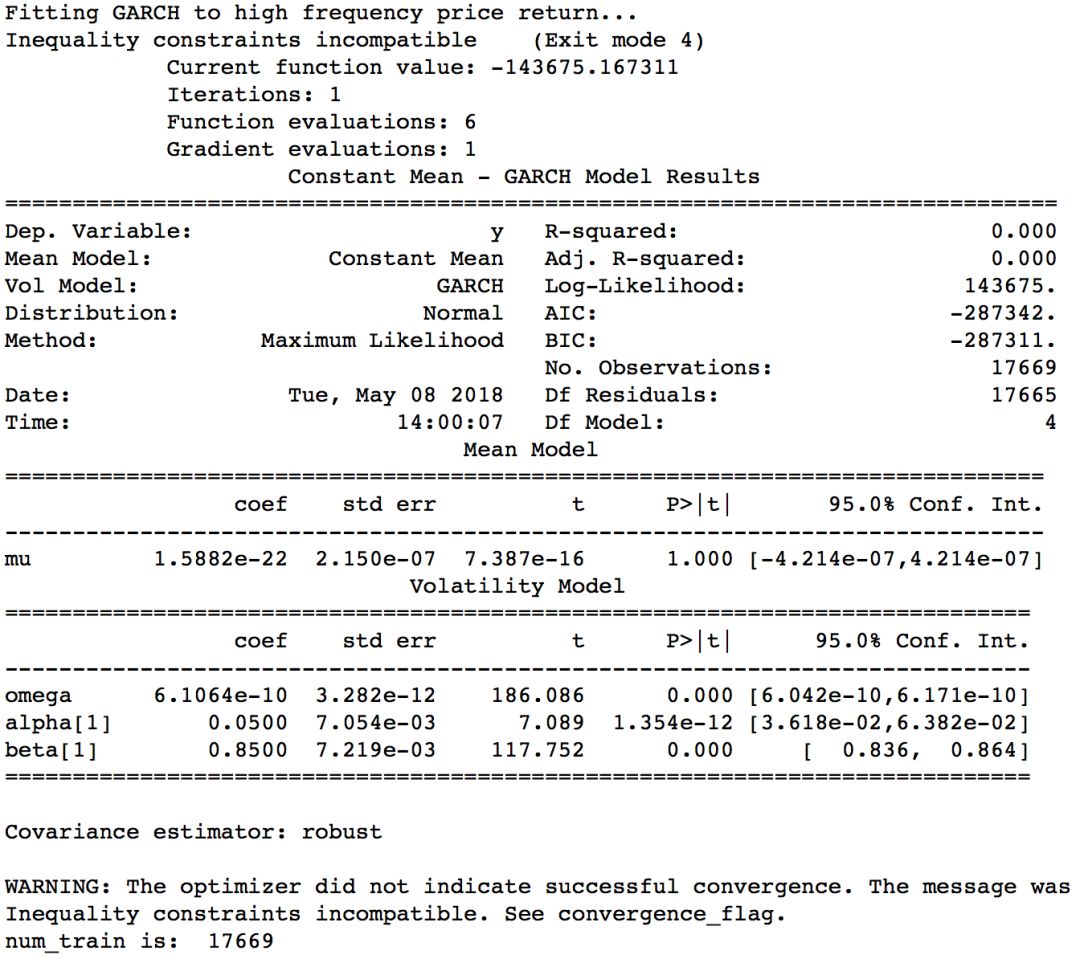

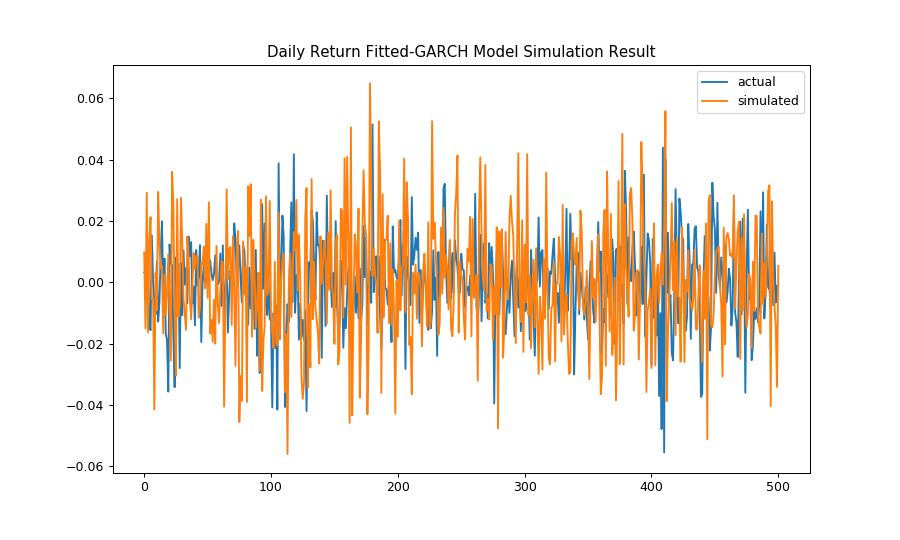

GARCH模拟

结论:时间序列模型仍然适用于高频数据。

缺点:

1、suboptimal parameters due to failure to converge.(未收敛)

2、can’t model discrete / tick-size or zero price return.

代码展示

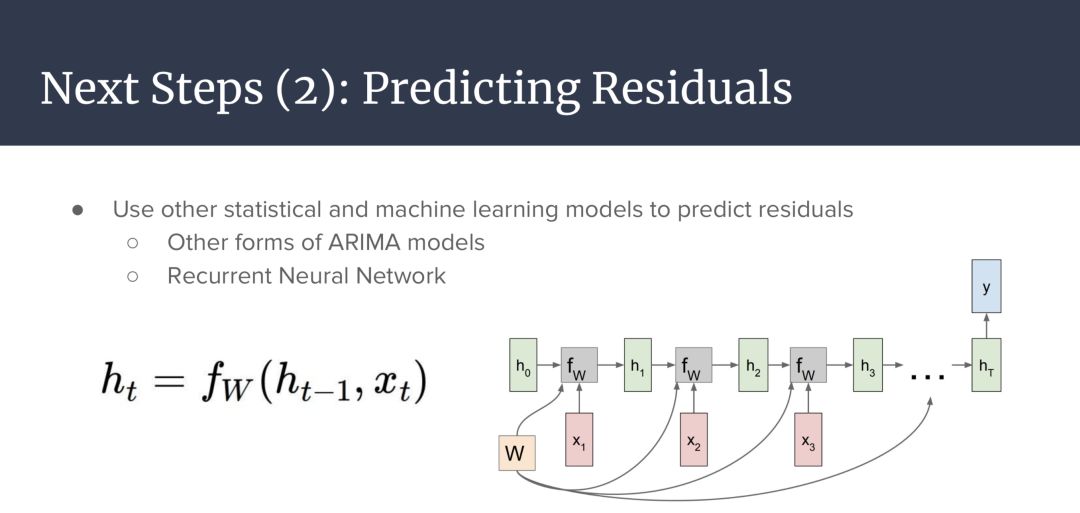

下面介绍其他的内容:

综合应用

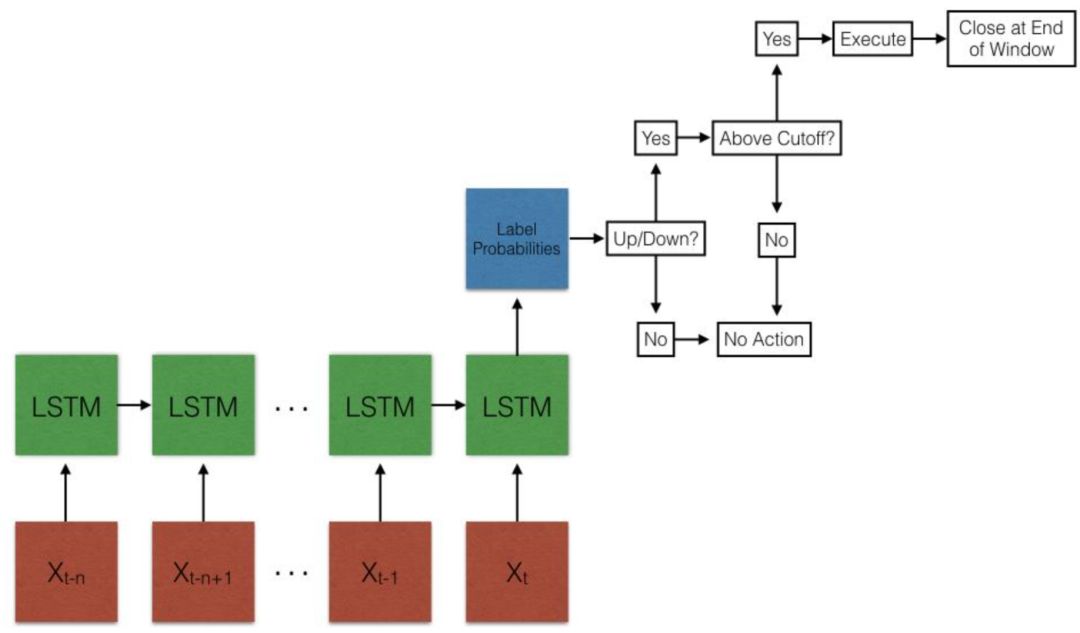

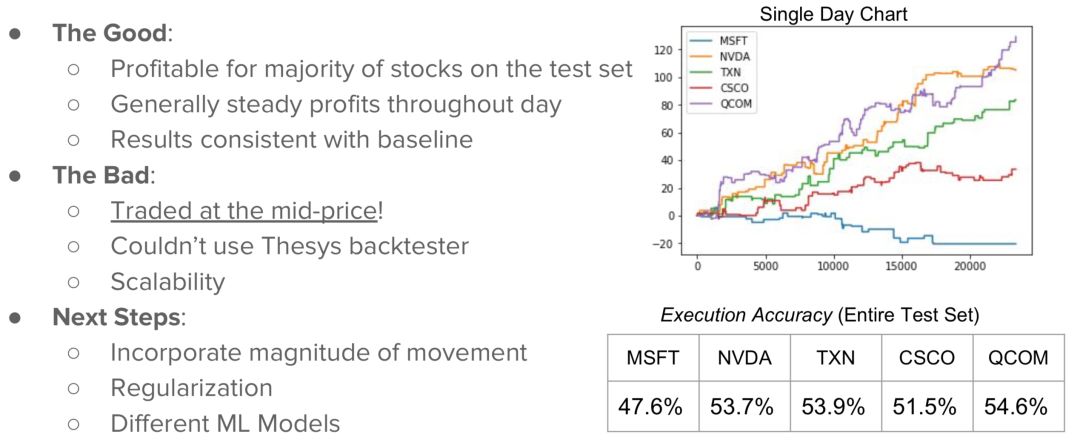

- RNN 策略

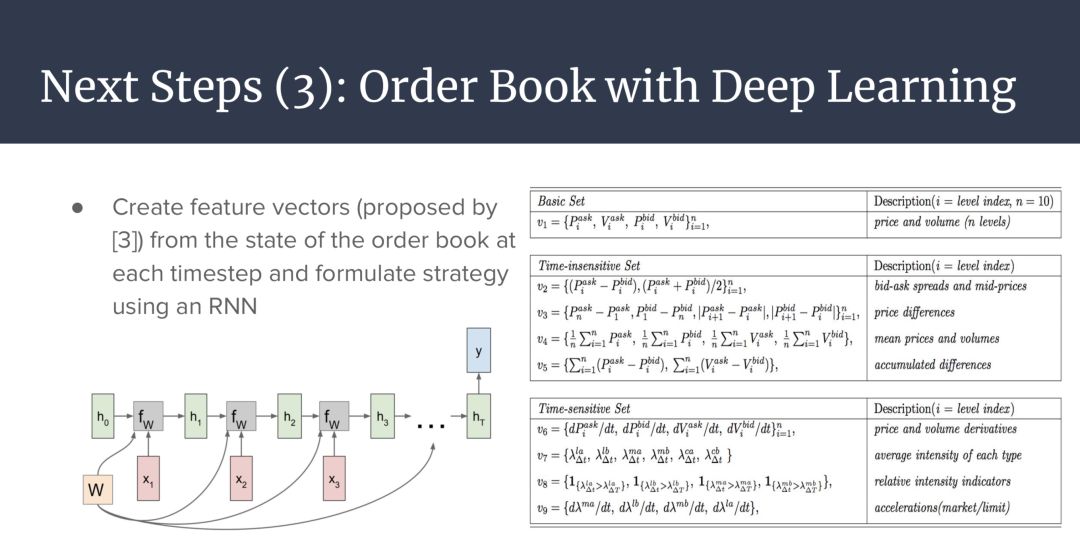

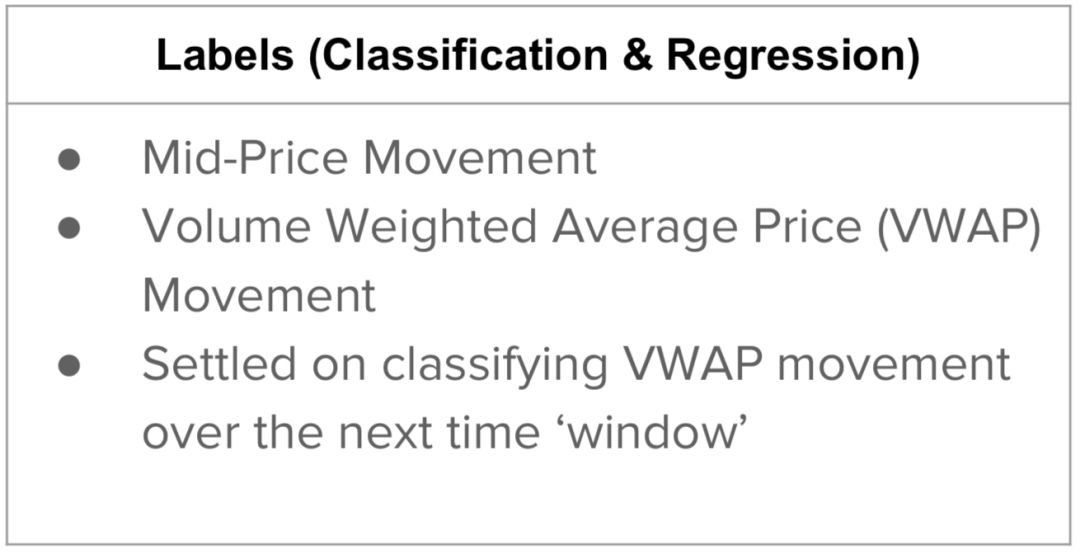

- 特征与标签生成

我们看到是一些基于量价和算法的特征

- 模型构成

- 策略思路

- 结果和后续操作

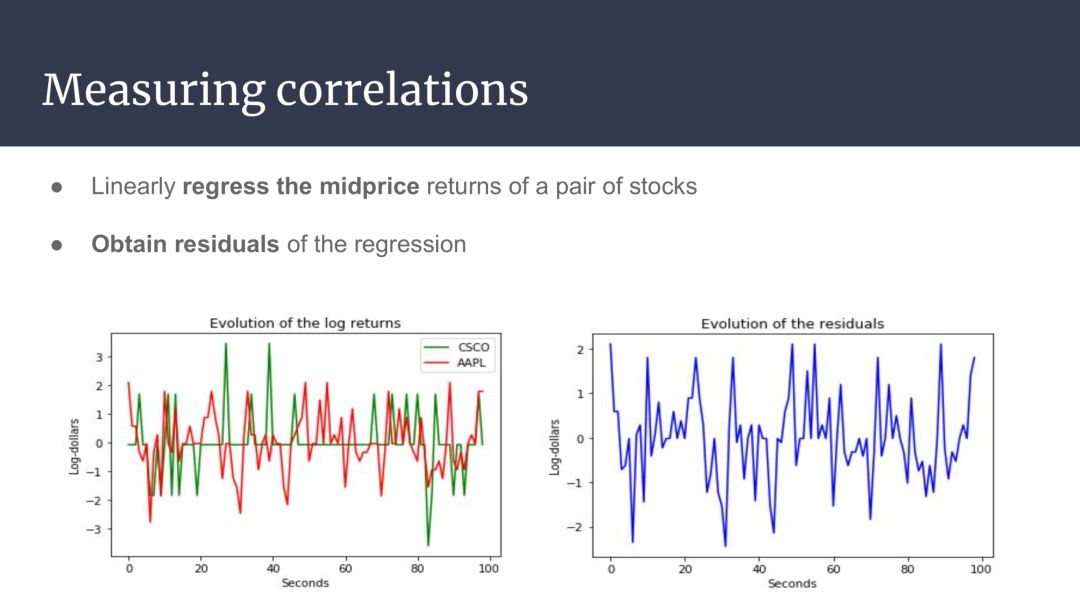

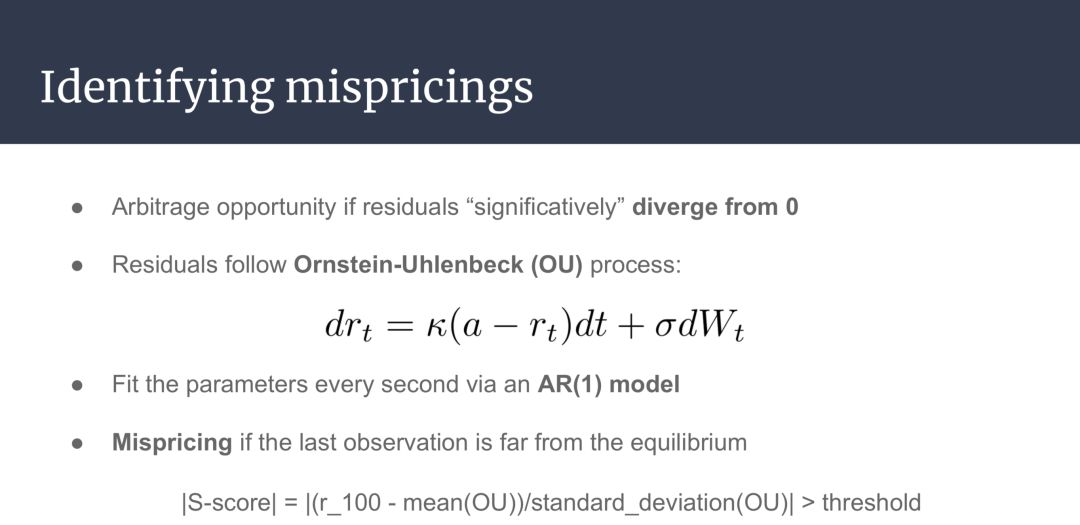

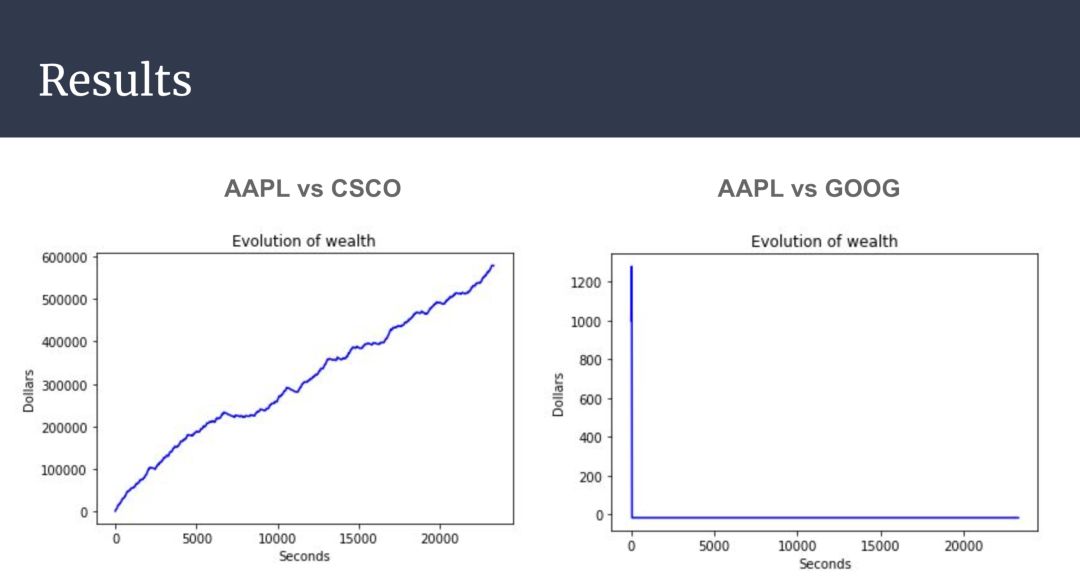

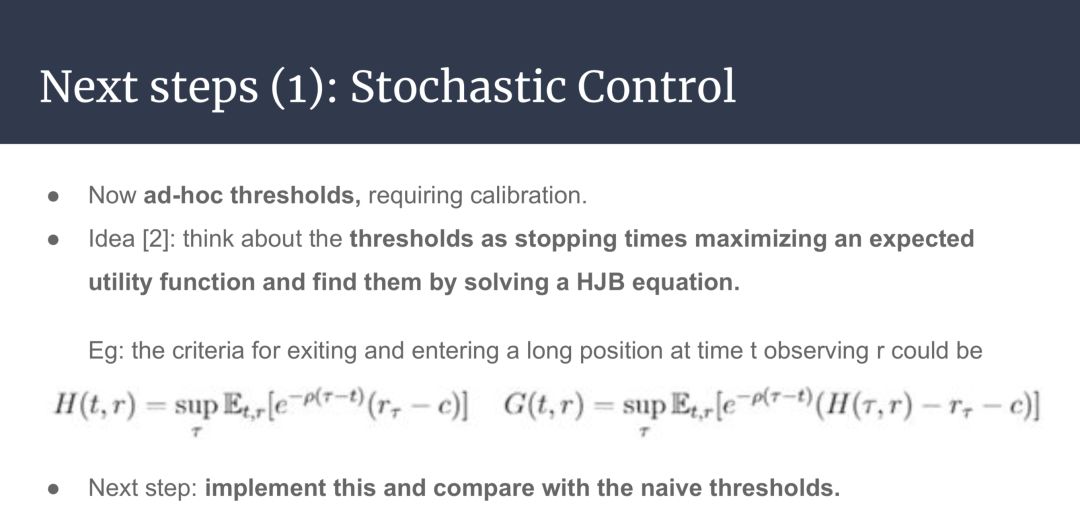

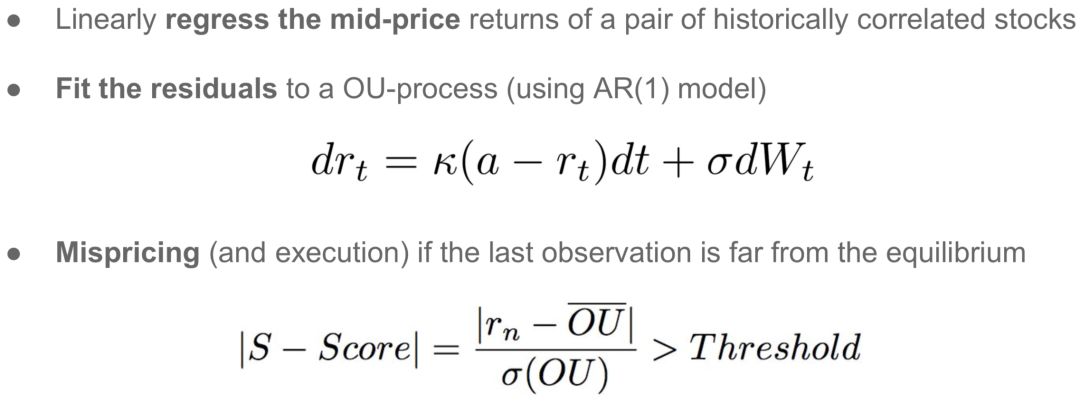

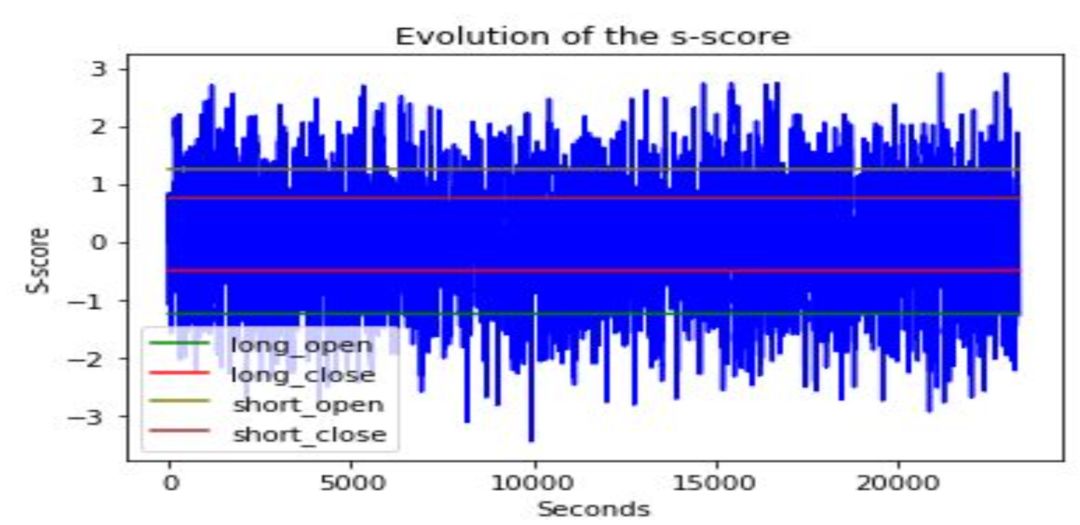

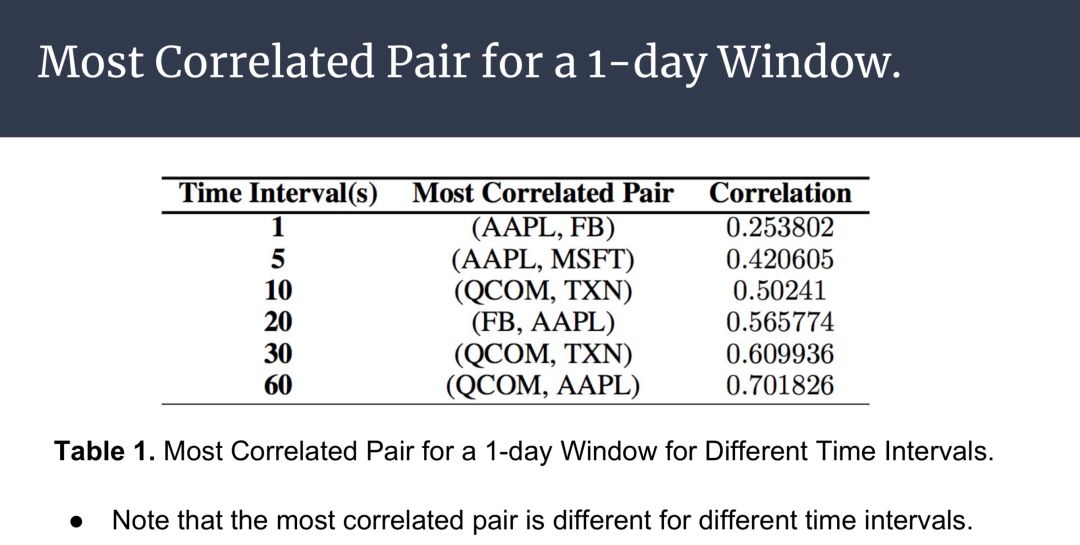

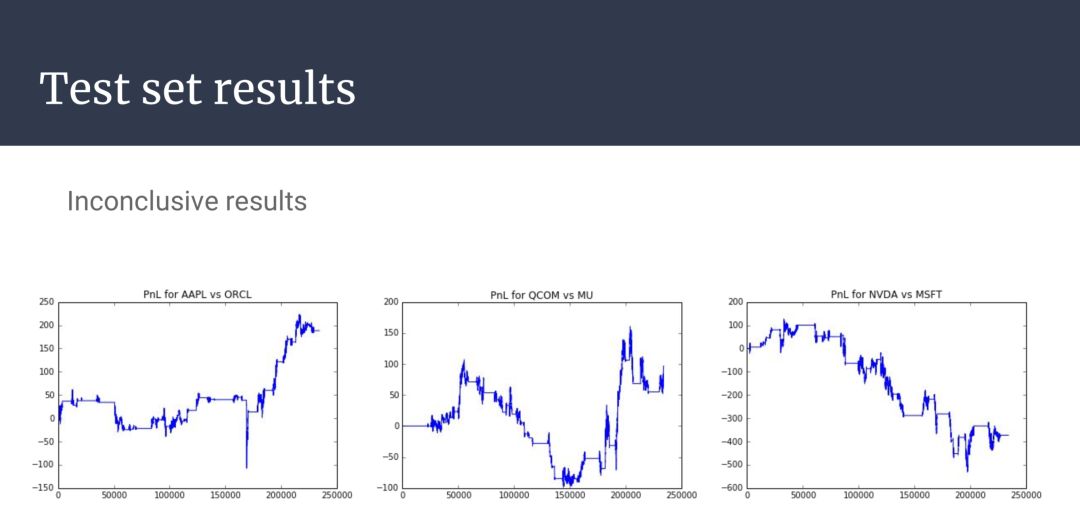

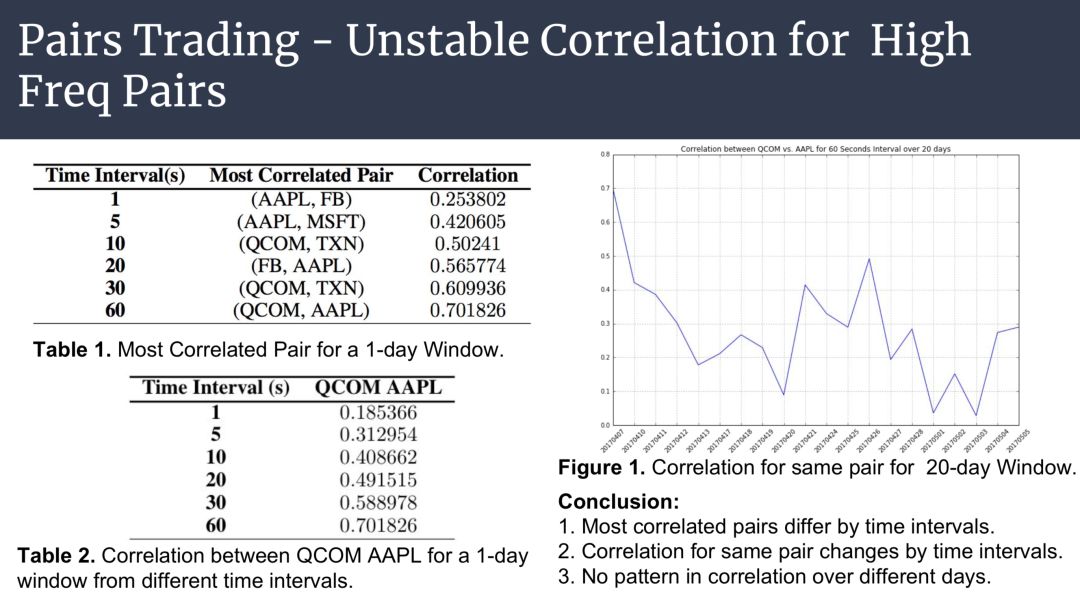

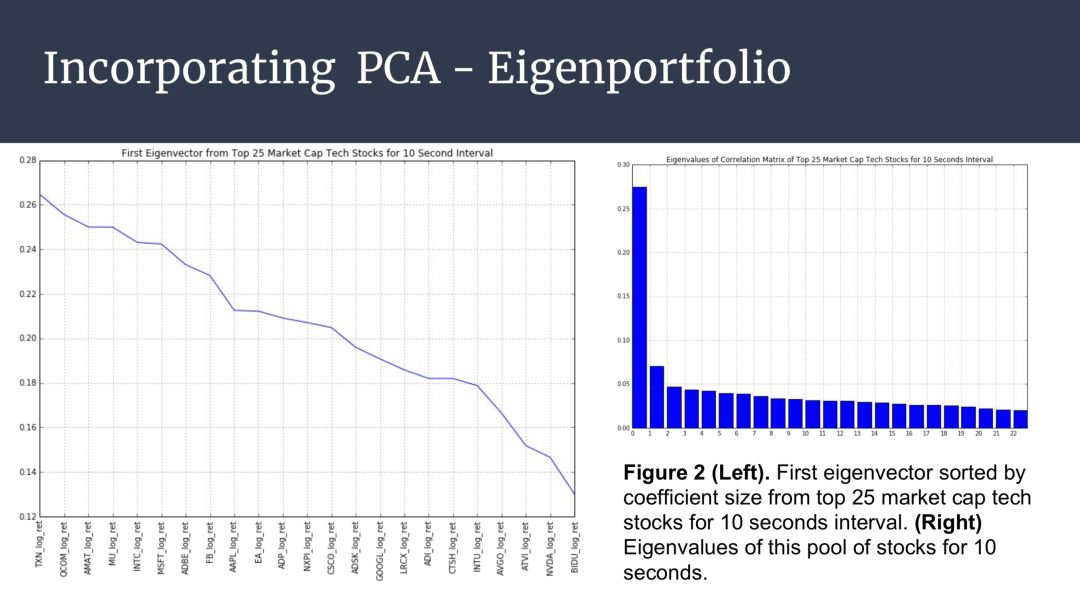

统计套利策略

- 配对交易基于 Avellaneda-Lee

举例

部分代码:

全部代码:

参考文献

[1] Avellaneda, M., & Lee, J. H. (2010). Statistical Arbitrage in the US Equities Market. Quantitative Finance, 10(7), p.761-782.

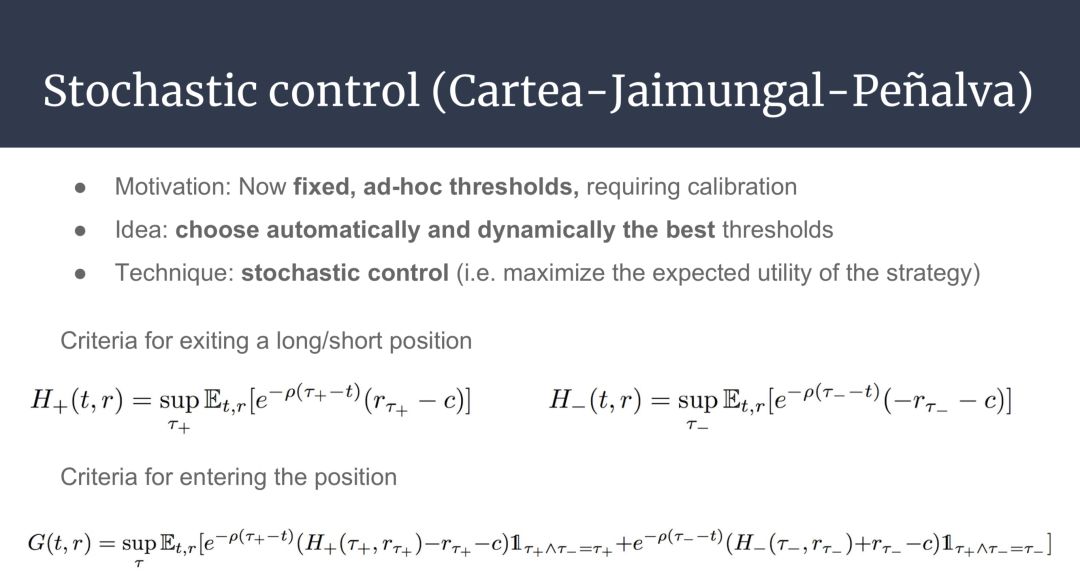

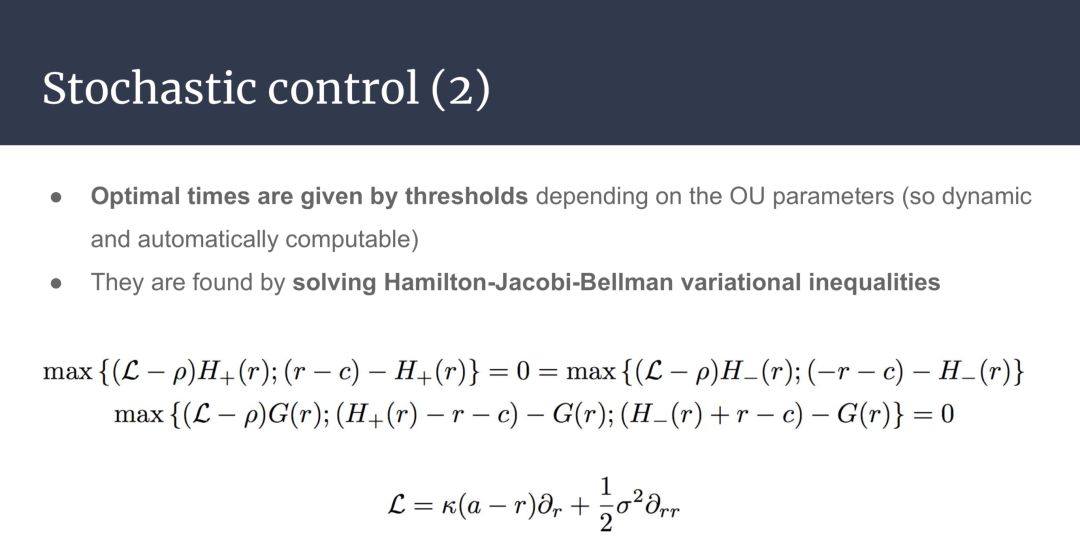

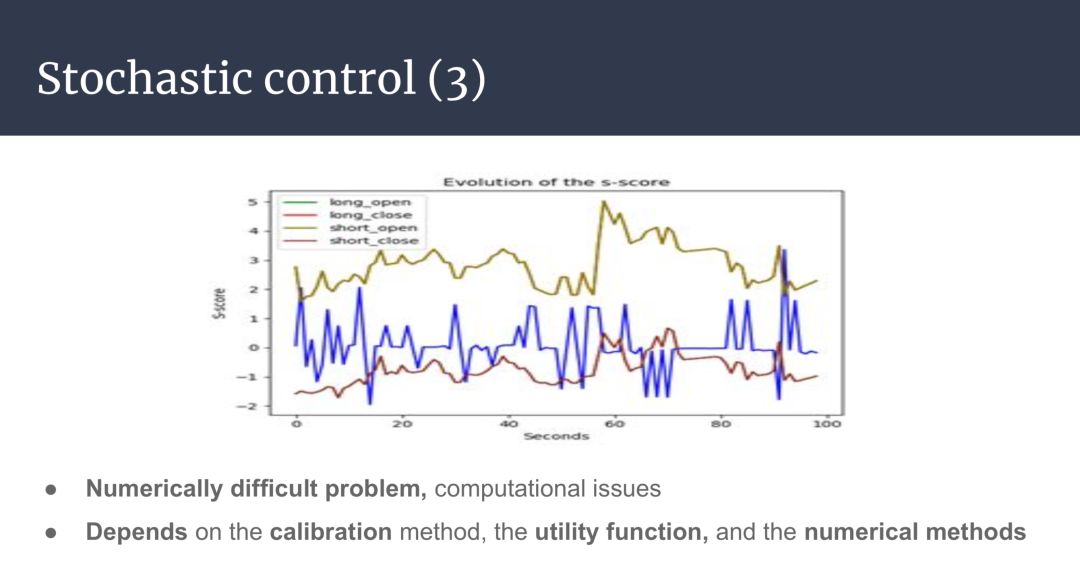

[2] Cartea, A., Jaimungal, S., and Peñalva, J. (2015). Algorithmic and high frequency trading. Cambridge University Press, chapter 11.

[3] Kercheval, A. and Zhang, Y. Modeling high-frequency limit order book dynamics with support vector machines. University of Florida, 2013